"Is a small business loan a variable or fixed rate?" Well, this is a mostly asked question by many people in the United States also. The answer is, neither every small business loan is fixed nor is variable. It depends on the organization giving loans. Similarly, some organizations provide variable interests on each loan, and some offer interest-free loans. Nonprofitable loans are the best.

People who are financially not stable usually need loans to start or pursue their dreams. Moreover, there are many different organizations that are working their best to provide people with loans. But choosing the one providing interest-free loans is a better option. Seed Out is one of them.

Is a small business loan a variable or fixed rate in Seed Out? In Seed Out the fundraising is according to the borrower's need and is completely interest-free. Therefore, there are a hell lot of success stories there. In short, the business loan rate is variable and easy to get.

How To Easily Get A Small Business Loan

How To Easily Get A Small Business Loan

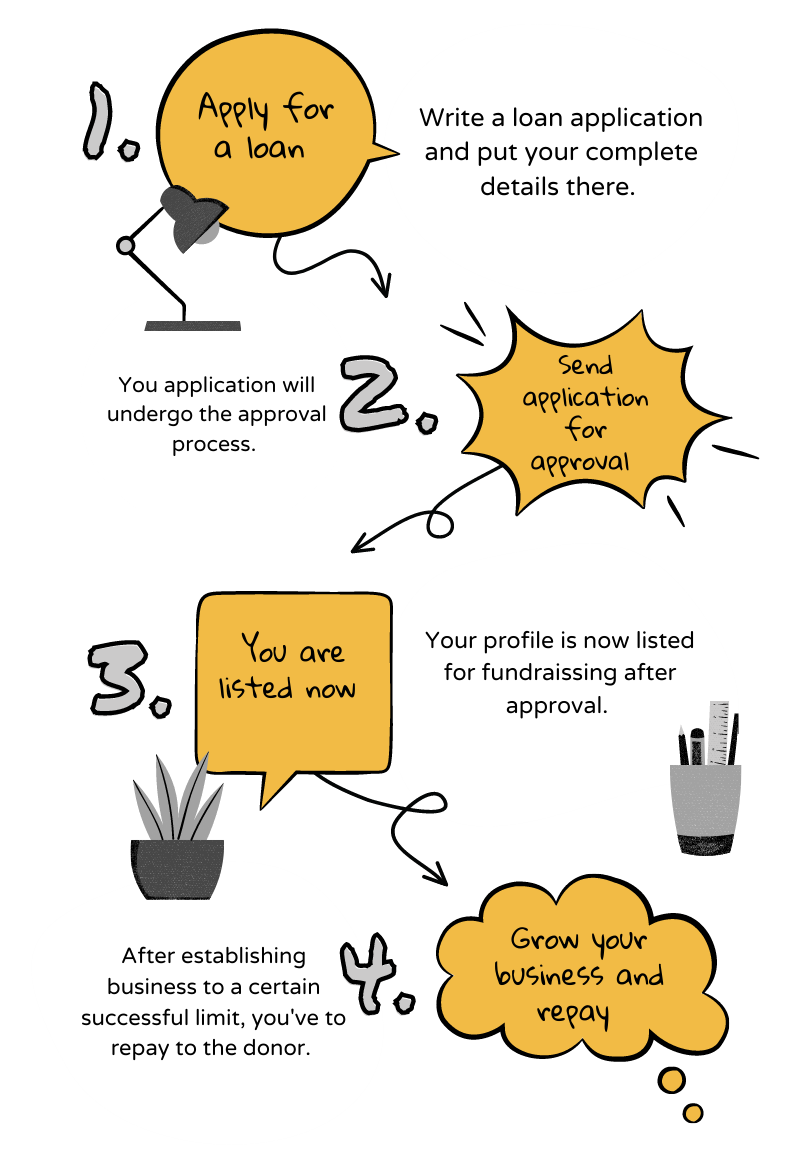

- You need to apply for a loan on Seed Out. For example, an application for a loan is required.

- Then the application will undergo the approval process. It is important to verify each and every detail of the borrower to be.

- Once the application gets approved, you will be on the list of borrowers on Seed Out. Your profile will help the donors for fundraising.

- The donor can track the money he/she donated.

After fundraising is complete and the borrower's business is in a suitable condition. He/She has to repay it back. A donor can help many people with the same money.

Variable Or Fixed Rate Small Business Loan In United States

Small businesses have a lot of issues, including the possibility of getting an advance with adaptable terms and low loan costs. Perhaps the greatest inquiry looked at by entrepreneurs is whether a small business loan is a variable or fixed rate? Would you be able to try and pick? Numerous banks require one sort of advance for a private company, settling on this decision at their caution. Both deal benefits, yet both fixed and variable rate advances have their cons too.

First of all, a great many people would say that decent financing cost business credits appear to bode well. Variable rates accompany aces too, similar to advertising impact and how financing costs can fall lower than fixed-rate advances. Be that as it may, variable-rate revenue credits can soar too, making this kind of advance a bet. Organizations by and large need to restrict their dangers and stay away from awful shocks. Given this reality, we would make the idea of going for a proper rate advance instead of a variable rate credit.

There are different purposes behind going with one over the other. On the off chance that your business advance financing cost never goes here and there, arranging can be simplified realizing how your regularly scheduled installments will turn up. On a home loan or individual advance, this benefit is quite significant. It turns out to be significantly more significant when what you can complete two months from now relies upon the amount you'll need to pay one month from now.

Individual accounting records rely intensely upon arranging, which is imperative for a business. Business loan interest rates that skyrocket and fall and skyrocket again make arranging more earnestly and conflicting. Hence, it is ideal to go with a fixed rate of interest loan.

Best Interest-Free Loans For Small Businesses

From the above discussion, it very well may be very befuddling and disappointed seeing such countless wellsprings of data on business loans. Remember that this subject has a great deal composed on it and there is a wide range of perspectives. It is ideal to gather everything you can to be completely educated on the financing cost of business advances. We accept we are giving you the best data that can as of now be discovered today regarding this matter as we sort through a great deal of outdated or immaterial discoveries to remain on top of it.

As there are many people asking that

"Is a small business loan a variable or fixed rate?" Also, can they get a small business loan without any interest?

What if you get the desired business loan with any kind of interest? This is a deal!

Yes, the best interest-free loans for small businesses. Through microfinancing, Seed Out is helping a head-spinning number of families and is also recognized by Forbes International Magazine. The organization won many awards in just a short period of time. So, it is best to donate to such a safe and widely known organization. Just tell me something you might donate to charity.

Donating money for business is best. It is because a business helps the whole family rather than a single person. Click here to check the success stories or you can visit our Success Stories page right now!

From there, it is extremely visible how people have successfully started their business through our interest-free microfinancing services.

We always try to give a better solution to every need regarding business loans. The process is 100% transparent. For example, as I mentioned earlier, the donor can track the money, and the borrower has to repay it back. I am amazed to tell you that the repayment rate on Seed Out is 97%. Isn't it great, right? Try to be a donor.

How To Become A Donor?

You can help someone by donating for their business through interest-free microfinancing. Donating and helping someone always gives you happiness. And by the way, seeing someone's smile just because of you, it's something beyond happiness. I hope you are understanding what am I trying to say right? You can easily become a donor.

- Go to the website www.seedout.org

- Sign up there

- Select the type of business you want to donate to. For example, food, clothing, manufacturing, transportation, retail etc.

- Select the borrower

- Select the amount of money you want to donate

- Checkout and complete payment

- Track money

See! how easy it is. So, if you want to make someone's life happier, don't delay. Your little effort is worthy for all of us. It makes both, the donor and the borrower, happier!

_1633708853.png) FAQs

FAQs

- Is a small business loan a variable or fixed rate?

- It can be variable or fixed depending on the organization. - Which one is the best organization for giving interest-free business loans?

- Because of its trustworthiness, Seed Out is widely known and is the best one for giving interest-free loans. - How to become a donor?

- It is quite easy. Also, you can check the answer in the "how to become a donor" section of this blog. - Does the borrower repay the donor?

- Of course, after reaching a successful stage, the borrower has to repay.